Danielle Kurtzleben reporting on GOP tax cuts and the middle class:

To help ensure their bill met the budget limits Republicans had set for themselves, lawmakers set many individual income tax changes to sunset after 2025 (however, they made cuts to corporate tax rates permanent).

For example, the bill changes tax rates across income brackets, increases the standard deduction and increases the child tax credit — but only until the end of 2025.

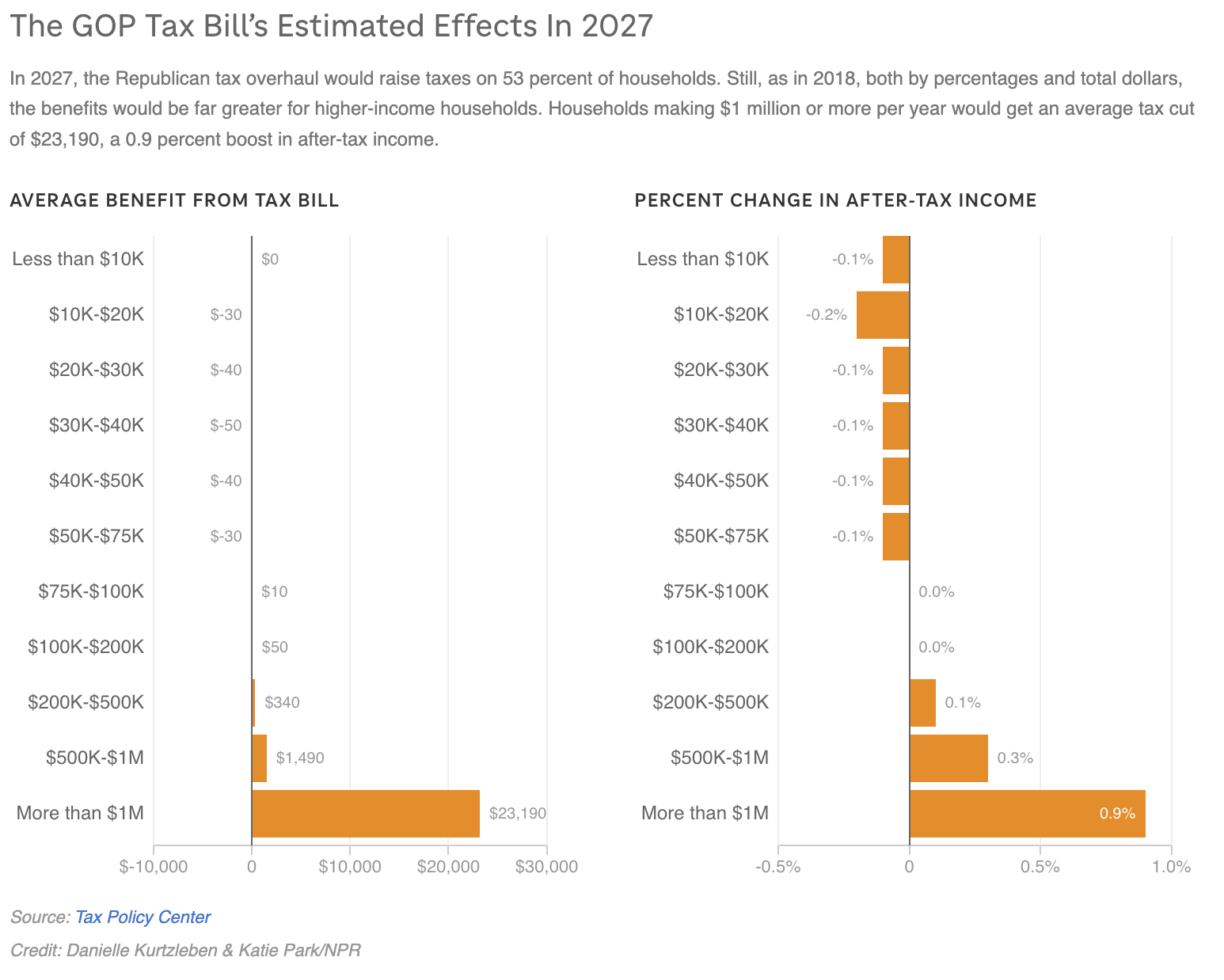

As a result, the Tax Policy Center predicts that in 2027, the average tax cut would amount to $160, or just a 0.2 percent income bump.

This would mean a tiny tax bump for many lower- and middle-class households — the average $50,000 to $75,000 — earning household would have a tax bill that is $30 higher than today. The average household earning more than $1 million would get a cut of more than $23,000.

Put another way, in 2018, households earning $1 million or more — or, 0.4 percent of all tax filers — would be getting 16.5 percent of the total benefit from the bill.

In 2027, households earning $1 million or more — estimated to be 0.6 percent of all filers — would be getting 81.8 percent of the total benefit, even though their average tax break would be about $46,000 smaller in 2027 than in 2018.

Yep. Thats right, if you make less then $75,000 your income loose $30 dollars or higher than today. Whats is even perverse is that those make over $1 million or more would see their income go up – by as much as $46,000.

FAFO.